The tax prep checklists below will help you

- Identify the most common IRS tax forms—the documents to keep in your Vital File (VF) with your tax returns

- Identify important tax records—the records to keep in your Important File (IF) for at least the long-term

- Create your own personalize tax prep checklist—a resource you can use year after year to simplify tax prep

Tax returns and forms

Many experts advise keeping tax returns including schedules, reporting forms, and tax payments records for a lifetime. Returns and tax payment records provide proof—if the IRS or your state suggest that you didn’t file, or that you filed but still owe.

Schedules and reporting forms in past tax returns provide essential information regarding your Social Security, investments, retirement benefits, and other financials. The information may be useful years down the road. They should be kept in your Vital File. Some of the most common tax forms include;

- W-2 from employers. It's a 1099-MISC form for self-employed.

- 1099's from banks and brokers for income, interest or dividends from investment, retirement, and other financial accounts. SSA-1099 for Social Security.

- 1098's from lenders for paid interest on a mortgage (1098) or on a student loan (1098-E). Colleges provide 1098-T to support education credits.

- 1095's from the health insurance marketplace (1095-A), your health insurer (1095-B), or by your employer (1095-C).

Another reason to keep tax returns and reporting forms forever

If you need an actual copy of a tax return—the current fee for an exact replica of a tax return is $50 per copy. Only the current tax year and as far back as six years are available from the IRS.

Tax records

A basic tax record is proof of payment. Payment records alone do not evidence that the item claimed on your return is allowable. You should keep other records that will help prove that the item is deductible.

The IRS has specific record-keeping requirements for each adjustment, deduction or credit. It is your responsibility to maintain the records that prove your adjustment, deduction or credit. They can be kept in your Important File for the long-term. This includes, but is not limited to;

- Charitable Deductions

- Healthcare Expenses

- College Educational Expenses

- Childcare

- Bank, Investment, Retirement, and other Financial Account Statements

Why keep monthly financial statements for the long-term?

Unless you receive detailed end-of-year statements, keeping monthly financial statements for all financial accounts for at least the long-term is something to consider seriously. Even your bank and credit card statements are important. Not only are they your most basic income and expense records, but they are also proof of payment for many things. Financial statements have tax, legal, financial, and insurance implications.

See IRS Publication 17, Your Federal Income Tax for more information

The documents and records listed on this checklist belong in your Vital File or Important File.

2 Tax Checklists That Can Help Simplify Tax Prep

Create your own personalize tax prep checklist—a resource you can use year after year!

Tax Prep Checklist | free

This is a free download but requires your name and email. Your info will be kept private and will only be used to notify you of updates to this resource and new products.

How do I use these checklists?

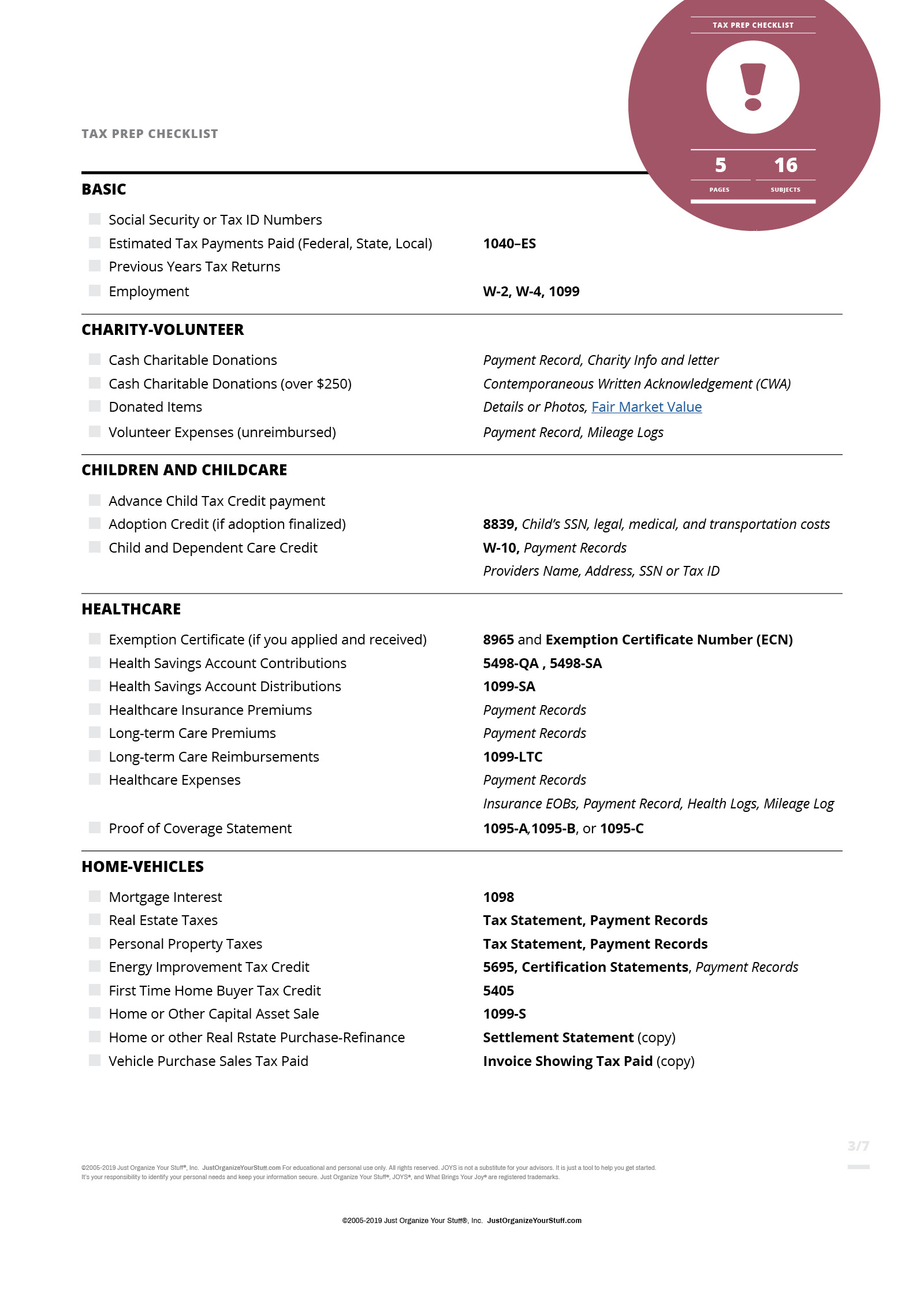

The Tax Prep Checklist is a reference to help you locate all the papers you need to prepare and support your taxes. Review the Tax Prep Checklist and cross off anything that is not relevant to your needs. This list is not all-inclusive. Consult your advisor if you have questions.

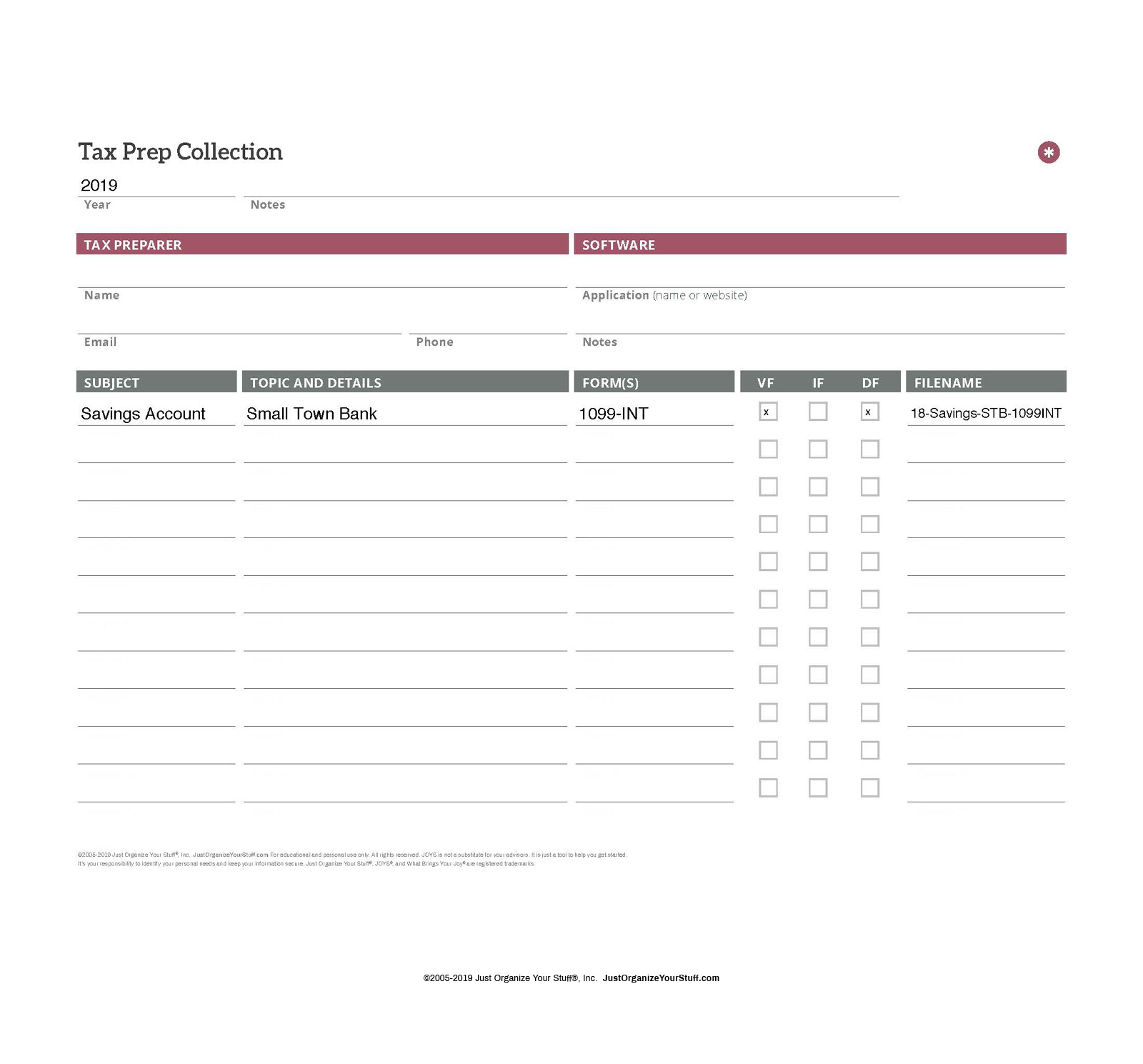

After reviewing the Tax Prep Checklist, create your own customized Tax Prep Collection checklist that will be specific to your needs. The personalized checklist can be referred to year after year and will make tax time easier for you.

A note on more challenging recordkeeping needs

Create dedicated files for challenging subjects (like the ones listed below)—in your Important File. The bulk of these papers will support financial, legal, insurance, and tax needs if they arise. Hopefully, you will never have to refer to them again, but many experts suggest keeping these papers for a lifetime.

- Adoption Records

- Bankruptcy Records

- Divorce-Custody Records

- Estate Inheritance Records

- Estate Trustee Records

- Home Damage-Theft Records

- Identity Recovery Records

- Tax Audit Support Records

2 Tax Checklists That Can Help Simplify Tax Prep

Create your own personalize tax prep checklist—a resource you can use year after year!

Tax Prep Checklist | free

This is a free download but requires your name and email. Your info will be kept private and will only be used to notify you of updates to this resource and new products.